child tax credit 2021 october

That means if a five-year-old turns six in 2021 the parents will receive a total credit of 3000 for the. 152 PM EDT October 15 2021.

When To Expect Next Child Tax Credit Payment And More October Tax Tips

We explain the key deadlines for child tax credit in October.

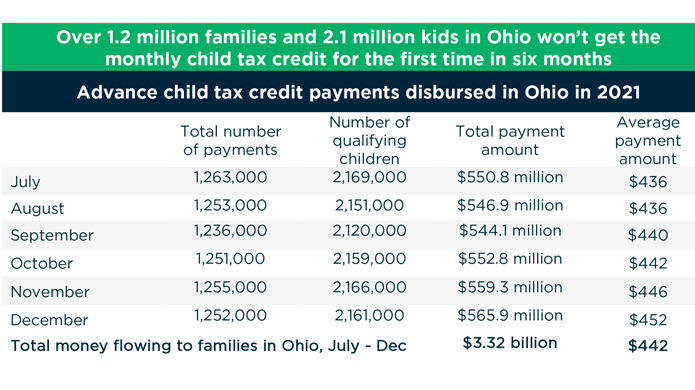

. For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks through the mail anywhere from a few days. 300 for families with children under 6 years old and 250 for. 2 days agoThe Internal Revenue Service IRS distributed half of the credit in monthly checks from July to December 2021.

The fourth advance child tax credits payment will land in bank accounts and as paper checks on October 15. That depends on your household income and family size. Calculation of the 2021 Child Tax Credit Earned Income Tax Credit Businesses and Self.

1252 PM CDT October 15 2021. The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from poverty in October 2021. WASHINGTON The Internal Revenue Service reminds families that some.

2 days agoChild Tax Credit Changes. Up to 3600 per child or up to 1800 per child if you received. Enhanced child tax credit.

The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and through the. As part of the continuing process of building out the advance CTC program which has included outreach to bring in previous non-filers and the launch of the CTC Update Portal that has allowed millions of. The Child Tax Credit reached 611 million children in.

How much money you could be getting from child tax credit and stimulus payments. The credit enabled most working families to claim 3000 per child under 18 years of age and 3600 per child six and younger. You must be the parent or guardian of a child who is under the age of 17 and who is a US.

Combined with other relief efforts the expansion helped lower child poverty by more than 40. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families who did not opt-out will receive 300 monthly for each child under 6. Grandparents and other relatives with eligible dependents can qualify for 2021 Child Tax Credit.

To claim the child tax credit you must first meet a few basic requirements. One is to wait until you file your 2021 taxes next April and collect the payments you missed out on. October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion.

All eligible families could receive the full credit if. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child for. The payments stemmed from a temporary enhancement to the child tax credit that Congress enacted as part of the 19 trillion American Rescue Plan Act that passed in March.

The Child Tax Credit expansion drove child poverty sharply downward in 2021. If you think thats why your October Child Tax Credit payment is missing you have two options. Home 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic C.

Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6. The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and. Individuals who earned less than 200000 in 2021 will receive a 50 income tax rebate while couples filing jointly with incomes under 400000 will receive 100.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying. Parents of a child who ages out of an age bracket are paid the lesser amount.

What Is The Child Tax Credit And How Much Of It Is Refundable

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Advance Child Tax Credit Update October 12 2021 Youtube

Child Tax Credit More Than 15 Billion In Payments Distributed On Friday Cnn Politics

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Woai

Child Tax Credits When Is The October Payment And What Is The Deadline To Unenroll From Monthly Payments

What S At Stake For Families As The Monthly Child Tax Credit Payment Ends Ohio Capital Journal

Child Tax Credit 2021 Update Families Won T Receive Any 300 Relief Payments Unless They Act By This October Deadline The Us Sun

Fact Sheet Advance Child Tax Credit

Child Tax Credit 2021 Here S Who Will Get Up To 1 800 Per Child Nj Com

You May Be Surprised By Cuts In October Child Tax Credit

Advance Child Tax Credit Update October 15 2021 Youtube

How To Get Up To 3 600 Child Income Tax Credit Now Michael Ryan Money

Child Tax Credit Updates What Time What If Amount Is Wrong

New Child Tax Credit Explained When Will Monthly Payments Start Ktvb Com

How Much Money Has The Child Tax Credit Given Families In 2021 As Usa

Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com